Walmart stands tall as one of the most dominant retail chains in the world, setting standards that reverberate across the global retail sector.

As of 2026, the retail titan boasts a sprawling network of approximately 10,660 locations, which includes 4,606 in the United States alone. The company is a significant employer, offering jobs to around 2.1 million individuals globally, with1.6 million of those employees based in America.

Expanding its reach into various international markets, Walmart maintains a diversified array of store formats, such as Walmart Supercenters, Neighborhood Markets, and Sam’s Club.

In this article, we will delve into Walmart’s customer demographics, store distribution, revenue streams, employee statistics, and more, providing a comprehensive overview that reflects the company’s stature in 2026.

Walmart Statistics 2026: Key Insights

- Customer Engagement: Walmart experiences approximately 255 million customer visits each week.

- Global Store Count: The retailer manages 10,660 stores worldwide.

- U.S. Operations: Within the U.S., Walmart operates 4,606 stores alongside 600 Sam’s Club locations.

- International Presence: The company has 5,454 stores spread across various countries.

- Financial Achievement: Walmart’s revenue reached $500.4 billion during the first three quarters of fiscal year 2026, highlighting its robust financial health.

- Workforce: Walmart employs about 2.1 million individuals worldwide.

Customer Demographics: Who Shops at Walmart?

Walmart has long attracted a broad customer base, recording around 255 million visits every week globally. This marks a rise from 240 million visits in 2023, reflecting an increase of 15 million visits within a year.

The following dataset illustrates the weekly visits to Walmart over the last few years:

| Year | Weekly Customer Visits |

|---|---|

| 2024 | 255 million |

| 2023 | 240 million |

| 2022 | 230 million |

| 2021 | 240 million |

| 2020 | 265 million |

| 2019 | 275 million |

| 2018 | 270 million |

| 2017 | 260 million |

Additional Customer Insights

- A considerable 95% of Americans visit a Walmart store at least twice a year.

- On average, a Walmart shopper makes about 67 trips annually, including those to Sam’s Club.

- Customers tend to spend approximately $54 on an average of 13 items per visit.

- The prototypical Walmart shopper is identified as a white baby boomer with an income below $80,000.

- The company generates daily earnings exceeding $1.56 billion from its extensive customer base.

Store Distribution: How Many Locations Does Walmart Operate?

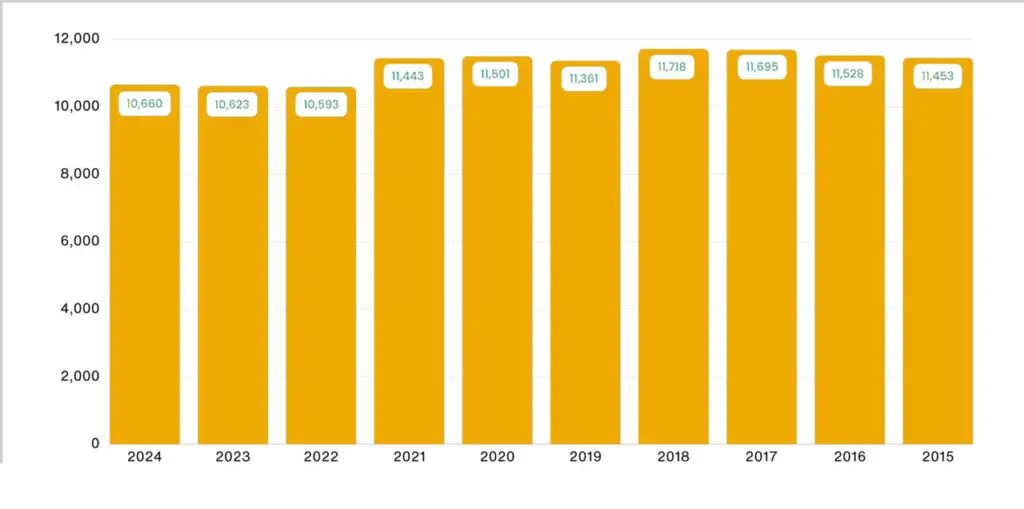

Walmart’s global footprint consists of 10,660 stores, reflecting a modest increase from 10,623 in 2023, indicating a strategic growth trajectory. While the peak store count was recorded at 11,718 in 2018, a downward trend began following that year. However, after hitting a low of 10,593 stores in 2022, Walmart has rebounded with a steady increase in store numbers during the subsequent years.

You may like this also: Telegram User Statistics

The following table outlines the number of stores managed by Walmart across the years:

| Year | Number Of Walmart Stores |

|---|---|

| 2024 | 10,660 |

| 2023 | 10,623 |

| 2022 | 10,593 |

| 2021 | 11,443 |

| 2020 | 11,501 |

| 2019 | 11,361 |

| 2018 | 11,718 |

| 2017 | 11,695 |

| 2016 | 11,528 |

| 2015 | 11,453 |

Source: Statista, Walmart.

Distribution of Walmart Stores in the United States

Of the 10,660 worldwide, 4,606 Walmart stores are found within the United States, complemented by 600 Sam’s Club outlets. Over the past year, Walmart has seen a closure of 111 retail locations, contributing to a gradual decrease in its domestic footprint since the peak of 4,769 stores in 2019.

The following statistics detail the evolving landscape of Walmart’s U.S. stores:

| Year | Walmart Retail Units in U.S. (Excluding Sam’s Club) |

|---|---|

| 2024 | 4,606 |

| 2023 | 4,717 |

| 2022 | 4,742 |

| 2021 | 4,743 |

| 2020 | 4,756 |

| 2019 | 4,769 |

| 2018 | 4,761 |

| 2017 | 4,672 |

| 2016 | 4,574 |

| 2015 | 4,516 |

Source: Statista, Walmart.

Breakdown of Store Types in the U.S.

Walmart’s 4,606 U.S. stores fall under different categories, including:

- Supercenters: 3,559

- Neighborhood Markets: 672

- Discount Stores: 355

- Small Format Stores: 20

While Supercenters have remained relatively stable, Neighborhood Markets and Discount Stores have witnessed notable declines. The number of Supercenters has fluctuated slightly, peaking at 3,573 in 2022, and has recently dipped to 3,559. On the other hand, the count of Neighborhood Markets has reduced significantly from a high of 813 in 2019, while Discount Stores have steadily decreased from 415 to 355.

| Year | Walmart Supercenters | Neighborhood Markets | Discount Stores |

|---|---|---|---|

| 2024 | 3,559 | 672 | 355 |

| 2023 | 3,572 | 781 | 364 |

| 2022 | 3,573 | 799 | 370 |

| 2021 | 3,570 | 799 | 374 |

| 2020 | 3,571 | 809 | 376 |

| 2019 | 3,570 | 813 | 386 |

| 2018 | 3,561 | 800 | 400 |

| 2017 | 3,552 | 735 | 415 |

| 2016 | 3,465 | 667 | 442 |

| 2015 | 3,407 | 639 | 470 |

Source: Walmart, Statista.

State-wise Distribution of Walmart Stores

Texas leads the United States in terms of Walmart locations, boasting 601 stores. Florida follows with 386, while California has 320.

Here’s a quick glance at states with the highest number of Walmart stores:

| State | Number of Walmart Stores |

|---|---|

| Texas | 601 |

| Florida | 386 |

| California | 320 |

| North Carolina | 216 |

| Georgia | 215 |

| Illinois | 190 |

| Ohio | 172 |

| Pennsylvania | 162 |

| Missouri | 158 |

| Tennessee | 151 |

Source: Statista.

Conversely, Washington D.C. has the least number of Walmart outlets, with just 5 stores, followed closely by Vermont with 6 and Alaska with 9.

| States | Number of Walmart Stores |

|---|---|

| Washington D.C. | 5 |

| Vermont | 6 |

| Alaska | 9 |

| Rhode Island | 9 |

| Delaware | 10 |

| Hawaii | 12 |

| Wyoming | 14 |

| Montana | 16 |

| South Dakota | 17 |

Source: Statista.

The International Presence of Walmart

Expanding its reach beyond the U.S., Walmart operates 5,454 stores internationally, showcasing growth from 5,305 stores in the previous year. This increase follows a significant drop from 6,101 stores in 2021, highlighting the fluctuations in its international operations.

You may like this also: How Many People Use X (Twitter)

Here’s a summary of Walmart’s international store count over recent years:

| Year | Number of Walmart International Stores |

|---|---|

| 2024 | 5,454 |

| 2023 | 5,305 |

| 2022 | 5,251 |

| 2021 | 6,101 |

| 2020 | 6,146 |

| 2019 | 5,993 |

| 2018 | 6,360 |

| 2017 | 6,363 |

| 2016 | 6,299 |

Source: Statista, Walmart.

Country-Specific Breakdown of Walmart Stores

Walmart’s footprint varies widely across different countries, as illustrated below:

| Country | Number of Walmart Stores |

|---|---|

| United States | 4,606 |

| Mexico | 3,066 |

| Canada | 403 |

| Chile | 395 |

| China | 332 |

| Africa | 320 |

| Costa Rica | 327 |

| Guatemala | 267 |

| Honduras | 114 |

| El Salvador | 102 |

| Nicaragua | 102 |

| India | 26 |

Source: Walmart Investor Relations.

Sam’s Club Overview

The Sam’s Club division includes 600 locations in the United States, which functions as a membership-based wholesale warehouse offering various products at reduced prices. The number of Sam’s Club outlets has seen a slight decline from 660 in 2017. Since 2019, this figure has remained relatively stable, oscillating between 599 and 600 locations.

Here’s a historical view of Sam’s Club store counts:

| Year | Number of Sam’s Club Stores |

|---|---|

| 2024 | 600 |

| 2023 | 600 |

| 2022 | 600 |

| 2021 | 599 |

| 2020 | 599 |

| 2019 | 599 |

| 2018 | 597 |

| 2017 | 660 |

| 2016 | 655 |

Source: Walmart Investor Relations, Statista.

Financial Performance of Walmart

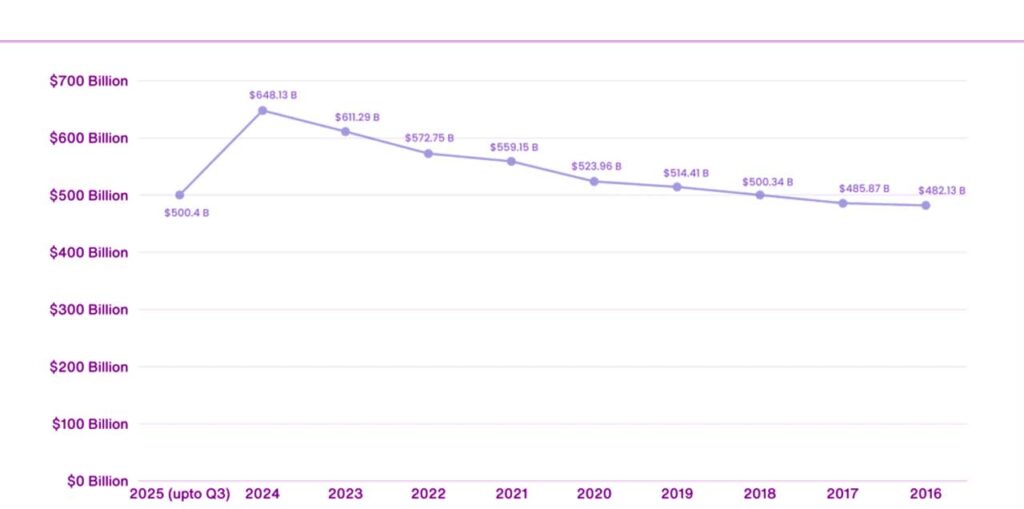

Walmart’s financial stature remains formidable, with a reported revenue of $500.4 billion for the first three quarters of the fiscal year 2025. The breakdown reveals that $169.6 billion was generated in the third quarter alone, marking a year-over-year growth of 5.5%. Comparatively, Walmart achieved a record revenue of $648.13 billion in fiscal year 2024, reflecting a robust upward trajectory.

Below is a historical overview of Walmart’s revenue:

| Financial Year | Walmart’s Revenue |

|---|---|

| 2025 (up to Q3) | $500.4 billion |

| 2024 | $648.13 billion |

| 2023 | $611.29 billion |

| 2022 | $572.75 billion |

| 2021 | $559.15 billion |

| 2020 | $523.96 billion |

| 2019 | $514.41 billion |

| 2018 | $500.34 billion |

| 2017 | $485.87 billion |

| 2016 | $482.13 billion |

Profitability Insights

Walmart’s profit margins also exhibit significant growth. In fiscal year 2024, the gross profit amounted to $157.98 billion, showcasing a 7.06% increase from the $147.58 billion recorded in 2023. The Q4 performance alone yielded $41.56 billion in gross profit, a 7.61% year-over-year growth.

| Year | Walmart Gross Profit |

|---|---|

| 2024 | $157.98 billion |

| 2023 | $147.57 billion |

| 2022 | $143.75 billion |

| 2021 | $138.84 billion |

| 2020 | $129.36 billion |

| 2019 | $129.10 billion |

| 2018 | $126.95 billion |

| 2017 | $124.62 billion |

| 2016 | $121.15 billion |

Source: Macro Trends.

Operating and Net Income Analysis

Walmart also reported operating income of $27.01 billion in fiscal year 2024, which represents a significant 32.23% increase compared to the previous year. The following table displays Walmart’s operating income over the years:

| Year | Operating Income |

|---|---|

| 2024 | $27.01 billion |

| 2023 | $20.42 billion |

| 2022 | $25.94 billion |

| 2021 | $22.55 billion |

| 2020 | $20.57 billion |

| 2019 | $21.96 billion |

| 2018 | $20.44 billion |

| 2017 | $22.76 billion |

| 2016 | $24.11 billion |

| 2015 | $27.15 billion |

Source: Macro Trends.

In fiscal year 2024, Walmart’s net income recorded an impressive $15.51 billion, marking a substantial 32.8% increase from the prior year’s income of $11.68 billion.

You may like this also How Many People Use Instagram

Here’s a snapshot of Walmart’s net income over the years:

| Fiscal Year | Walmart’s Net Income |

|---|---|

| 2024 | $15.51 billion |

| 2023 | $11.68 billion |

| 2022 | $13.67 billion |

| 2021 | $13.51 billion |

| 2020 | $14.88 billion |

| 2019 | $6.67 billion |

| 2018 | $9.86 billion |

| 2017 | $13.64 billion |

| 2016 | $14.69 billion |

| 2015 | $16.36 billion |

Source: Macro Trends.

Market Position and E-commerce Performance

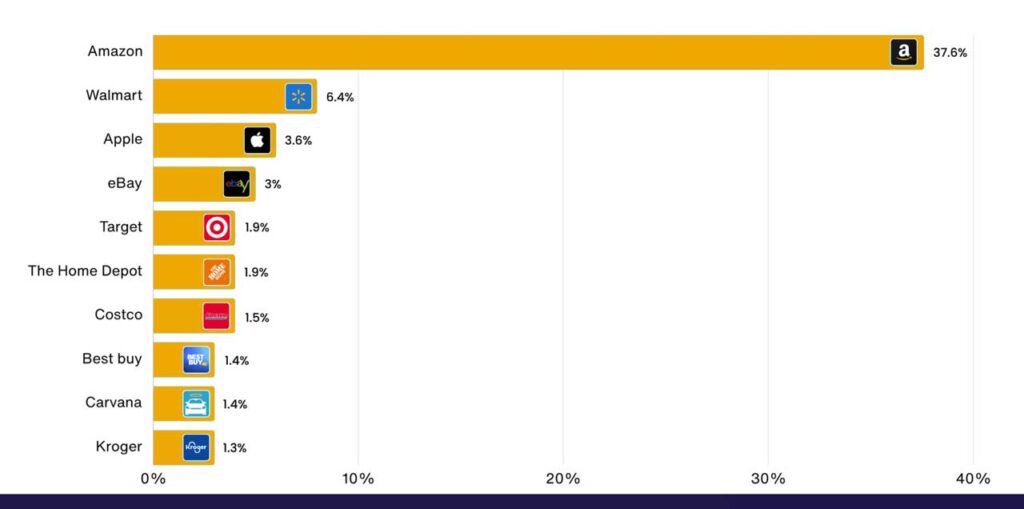

Walmart has secured a 6.4% share of the retail e-commerce market within the United States as of 2023. In comparison, Amazon retains a commanding lead with a market share of 37.6%. Other notable contenders in the e-commerce scene include Apple, eBay, and Target.

The table below outlines the market share of leading retail e-commerce companies in the U.S.:

| Retail E-Commerce Company | Market Share |

|---|---|

| Amazon | 37.6% |

| Walmart | 6.4% |

| Apple | 3.6% |

| eBay | 3% |

| Target | 1.9% |

| The Home Depot | 1.9% |

| Costco | 1.5% |

| Best Buy | 1.4% |

| Carvana | 1.4% |

| Kroger | 1.3% |

Source: Statista.

Walmart ranks as the fourth-largest online retailer globally, showcasing the company’s significant impact in the e-commerce space.

Employment and Workforce Insights

Walmart remains one of the largest employers in the world, providing jobs to roughly 2.1 million people globally, consistent with the figures from 2023. Approximately 1.6 million of these employees work within the United States. Notably, this represents a decline from the 2.3 million employees recorded in 2022 and 2021.

Here’s a timeline of Walmart’s employee statistics:

| Year | Number of Employees |

|---|---|

| 2024 | 2.1 million |

| 2023 | 2.1 million |

| 2022 | 2.3 million |

| 2021 | 2.3 million |

| 2020 | 2.2 million |

| 2019 | 2.2 million |

| 2018 | 2.3 million |

| 2017 | 2.3 million |

| 2016 | 2.3 million |

| 2015 | 2.2 million |

Source: Macro Trends.

Net Sales Overview

Walmart achieved net sales totaling $642.64 billion in the fiscal year 2024. This figure illustrates a robust growth of 6.07% compared to 2023, where net sales were recorded at $605.88 billion.

The following table shows Walmart’s net sales over the years:

| Fiscal Year | Net Sales |

|---|---|

| 2024 | $642.64 billion |

| 2023 | $605.88 billion |

| 2022 | $567.76 billion |

| 2021 | $555.23 billion |

| 2020 | $519.93 billion |

| 2019 | $510.33 billion |

| 2018 | $495.76 billion |

| 2017 | $481.32 billion |

| 2016 | $478.61 billion |

Source: Statista.

Division-specific Net Sales Breakdown

In fiscal year 2024, Walmart’s different divisions reported the following net sales:

| Year | Walmart U.S. | Walmart International | Sam’s Club |

|---|---|---|---|

| 2024 | $441.82 billion | $114.64 billion | $86.18 billion |

| 2023 | $420.55 billion | $100.98 billion | $84.35 billion |

| 2022 | $393.25 billion | $100.96 billion | $73.56 billion |

| 2021 | $369.96 billion | $121.36 billion | $63.91 billion |

| 2020 | $341 billion | $120.13 billion | $58.79 billion |

| 2019 | $331.67 billion | $120.82 billion | $57.84 billion |

| 2018 | $318.48 billion | $118.07 billion | $59.22 billion |

| 2017 | $307.83 billion | $116.12 billion | $57.37 billion |

| 2016 | $298.38 billion | $123.41 billion | $56.83 billion |

Source: Statista.

E-commerce Sales Trajectory

Walmart has reported net e-commerce sales reaching $60.412 billion in fiscal year 2024, which indicates a growth from $58.121 billion in fiscal year 2023, marking an increase of 3.94%.

The following table shows Walmart’s e-commerce sales performance over recent years:

| Fiscal Year | E-commerce Net Sales |

|---|---|

| 2024 | $60.41 billion |

| 2023 | $58.12 billion |

| 2022 | $52.40 billion |

| 2021 | $46.74 billion |

| 2020 | $41.56 billion |

| 2019 | $22.38 billion |

| 2018 | $14.26 billion |

| 2017 | $10.30 billion |

| 2016 | $7.57 billion |

Source: Statista.

Online Sales by Division

Walmart’s online sales for 2023 reflect the company’s progressive e-commerce strategy, showing the following breakdown:

| Year | Walmart U.S. | Walmart International | Sam’s Club |

|---|---|---|---|

| 2023 | $53.4 billion | $20.3 billion | $8.4 billion |

| 2022 | $47.8 billion | $18.5 billion | $6.9 billion |

| 2021 | $43 billion | $16.6 billion | $5.3 billion |

| 2020 | $24.1 billion | $11.8 billion | $3.8 billion |

| 2019 | $15.7 billion | $6.7 billion | $2.7 billion |

Source: Statista.

Addressing Theft and Security Concerns

Despite its exceptional growth, Walmart has faced challenges with theft and security. The company has acknowledged a pattern of at least one violent crime occurring each day at its stores, attributed to cost-cutting measures that led to diminished security provisions.

To mitigate losses due to theft, which averages around $3 billion annually, Walmart has implemented enhanced security measures, staff training, and the integration of technology such as AI to prevent shoplifting.

General Walmart Statistics

A few additional interesting facts about Walmart include:

- Walmart owns Flipkart, a major player in India’s e-commerce sector, commanding a 39% market share.

- A significant 56% of Walmart’s net sales derive from groceries, highlighting the company’s strength in food retail.

- The company allocated $3.1 billion towards advertising efforts.

Walmart’s Adaptation and Innovation

In the ever-evolving retail marketplace, Walmart’s ability to adapt to changes in consumer behavior and market dynamics has been a cornerstone of its enduring success. The company has demonstrated a keen awareness of technological advancements, consumer preferences, and global economic shifts, allowing it to strategically pivot its business model accordingly.

Embracing Technology

A significant area where Walmart has focused its innovation efforts is in the integration of technology. The company has made substantial investments in enhancing its supply chain logistics, streamlining operations, and improving the shopping experience for customers both in-store and online. For instance, Walmart has utilized automation in its warehouses and distribution centers, employing robotics to increase efficiency and speed in order fulfillment.

Additionally, Walmart has embraced data analytics to gain insights into customer shopping patterns, allowing for personalized marketing and inventory management that pertains to local preferences. This data-driven approach enables Walmart to better predict demand and manage stock levels, reducing waste and ensuring that customers find what they are looking for upon their visits.

Enhancing E-Commerce Capabilities

The surge in e-commerce, especially accelerated by the COVID-19 pandemic, has prompted Walmart to double down on its online sales strategy. The company continues to enhance its e-commerce platform through its website and mobile app, offering a robust shopping experience that includes grocery delivery, pickup services, and a wider selection of merchandise.

Walmart’s partnership with various delivery services has also expanded its reach. Initiatives like Walmart+, which offers membership perks similar to Amazon Prime, have been launched to attract more online shoppers. This program provides members with free shipping on eligible items, discounts on fuel, and access to exclusive products, reinforcing Walmart’s competitiveness in the online marketplace.

Sustainability Initiatives

Walmart has been increasingly focused on sustainability as part of its corporate strategy. Aiming to achieve zero emissions in its global operations by 2040, the company is investing in renewable energy, sustainable sourcing, and waste reduction initiatives.

Walmart has set specific targets to ensure 100% of its private brand packaging is recyclable, reusable, or compostable by 2025. Furthermore, the company has made commitments to reduce food waste by 50% by 2030, partnering with organizations to rescue food and increase donations to local food banks.

These sustainability efforts not only mitigate environmental impacts but also resonate with a growing base of eco-conscious consumers who prefer to shop at stores that actively promote sustainable practices.

Expansion Into Global Markets

Walmart’s international strategy remains a critical component of its growth blueprint. Expanding into new markets allows the retailer to diversify its revenue streams and tap into emerging consumer bases.

For instance, Walmart’s presence in India through its ownership of Flipkart has allowed it to capitalize on the burgeoning e-commerce sector in one of the world’s fastest-growing economies. Flipkart continues to introduce innovations and gather customer loyalty in India’s diverse retail landscape, which presents unique challenges and opportunities.

In markets like Africa and Latin America, Walmart has been adapting its store formats and product offerings to meet local consumer needs. For instance, in South Africa, the company operates under the Massmart brand, catering to local preferences and pricing sensitivity while ensuring that it maintains operational efficiency.

Customer Engagement and Experience

Understanding the importance of customer experience in a competitive landscape, Walmart has continuously sought to enhance how it interacts with shoppers. From in-store experiences to digital interactions, Walmart prioritizes customer service and engagement.

The integration of mobile technology into the shopping experience has made it easier for customers to access information, make choices, and even pay for purchases through their smartphones. Walmart’s app provides features like store maps, product availability checks, and customer reviews to assist shoppers in making informed decisions.

Moreover, Walmart has utilized customer feedback extensively to improve services continually. Regular surveys, social media engagement, and loyalty programs help pinpoint areas needing refinement, demonstrating the retailer’s commitment to listening to its customer base.

Challenges and Opportunities Ahead

Despite its successes, Walmart does face several challenges that could impact its future growth and profitability. Competition from online retail giants such as Amazon continues to be fierce, and emerging retail disruptors pose threats in many markets. Additionally, the changing regulatory landscape, especially concerning labor practices and environmental regulations, could create hurdles for the company.

On the flip side, these challenges also present opportunities. By focusing on its strengths, such as an extensive supply chain network, the convenience of its stores, and its increasing digital presence, Walmart can navigate these obstacles effectively. Enhancing its value proposition to provide exceptional customer service, competitive pricing, and diverse product offerings will help the company maintain its edge.

Community Impact and Social Responsibility

Walmart recognizes the significance of its role as a corporate citizen in the communities it serves. Over the years, the retailer has engaged in various philanthropic efforts, contributing millions to local organizations, educational initiatives, and disaster relief efforts.

Walmart’s commitment to diversity and inclusion within its workforce further bolsters its reputation as a responsible employer. The company actively promotes initiatives designed to advance female leadership and support minority-owned businesses, both within its operational framework and the communities around its stores.

Conclusion: Walmart’s Position in 2026

In summary, Walmart maintains a formidable presence with 10,660 stores worldwide, of which 4,606 are located in the U.S. The company welcomes an impressive 255 million visits from customers each week and has reported revenue of $500.4 billion in just the first three quarters of the 2026 fiscal year.

With a workforce of around 2.1 million employees, Walmart’s influence reaches far and wide, impacting local economies and communities. Given its consistent growth in store numbers and revenue generation, Walmart is poised to remain a crucial player in the retail industry for the foreseeable future. Its commitment to adapting to market dynamics and customer demands further solidifies its status as a leader in global retail.

Admin Choice: